Understanding Fees

As with anything you buy, there are fees and costs associated with investment products and services. These fees may seem small, but over time they can have a major impact on your investment portfolio. Understanding the fees you pay is important to investing wisely.

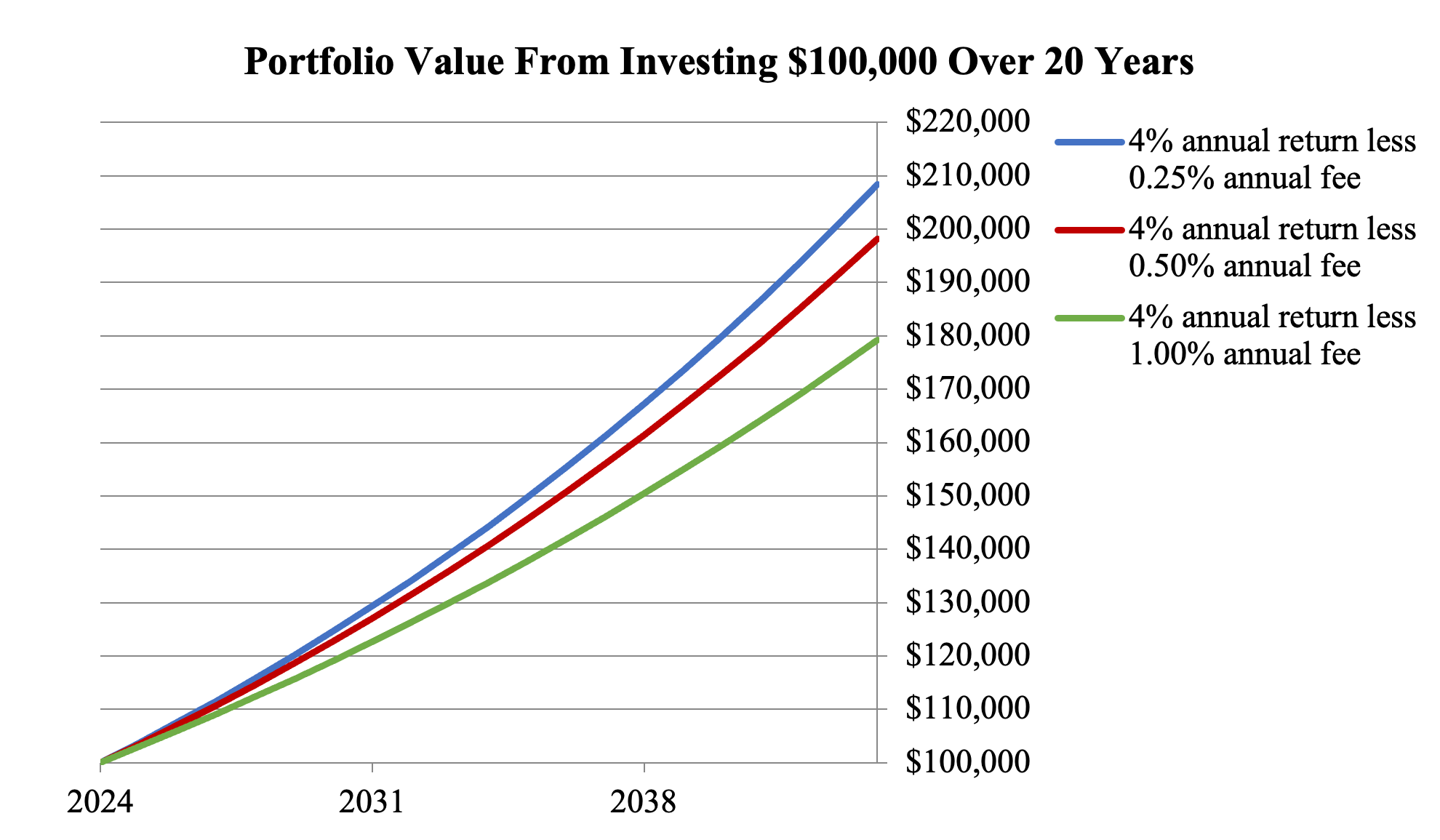

The following chart shows the impact of three different fees on a $100,000 investment that grows 4% annually over 20 years. Notice how the different fees affect the value of the hypothetical investment portfolio.

- The blue line represents the investment portfolio with an annual fee of 0.25%. At the end of 20 years, the portfolio would be worth approximately $208,000.

- The red line represents the investment portfolio with an annual fee of 0.50%. At the end of 20 years, the portfolio would be worth approximately $198,000.

- The green line represents the investment portfolio with an annual fee of 1.00%. At the end of 20 years, the portfolio would be worth approximately $179,000.

The best advice we can give you about understanding fees and investing wisely is to ask questions. For example:

- What are the total fees to purchase and sell this investment?

- Are there ways that I can reduce or avoid some of the fees I’ll pay, such as by purchasing the investment directly?

- How much does this investment have to increase in value before I break even?

- What are the ongoing fees to maintain my account?

- How do fees and expenses of the investment I'm considering compare to other investment products that can help me meet my investment objectives?

- For the investment professional: How do you get paid? By commission? By the amount of assets you manage? By another method? Do I have any choice on how to pay you? Should I pay you by the transaction, or pay a flat fee regardless of how many transactions I have?

Investment Products

Mutual Fund and ETF Fees and Expenses – Investor Bulletin

How Fees and Expenses Affect Your Investment Portfolio – Investor Bulletin

Investor Bulletin: Mutual Fund Classes

FINRA's Fund Analyzer (link is external)

Investment Services

Investor Bulletin: Brokers' Miscellaneous Fees

Investor Bulletin: Opening An Investment Advisory Account

Investor.gov/CRS

Investor Bulletin: How to Open a Brokerage Account

Subscription-based Advisory Fees: Investor Bulletin

Common Fee Types

Mutual Fund Fees and Expenses

12b-1 Fees

Distribution Fees

Sales Charge (Or Load)

Redemption Fee

Exchange Fee

Account Fee

Purchase Fee

Management Fee

Shareholder Service Fees

Total Annual Fund Operating Expense